- Home

-

MBBS

-

MBBS in India

-

MBBS Abroad

-

- Career After NEET

-

Career

-

School-Level (Class 5–10)

-

After Class 10 / 12 (College Entrance Exams For Engineering)

-

After Class 10 / 12 (College Entrance Exams For Medical)

-

After Class 10 / 12 (College Entrance Exams For Defence / Armed Forces )

-

After Class 10 / 12 (College Entrance Exams For Commerce / Management / General )

-

After Class 10 / 12 (College Entrance Exams For Design / Fashion / Architecture )

-

After Graduation (Government & Professional Jobs/Civil Services & Administration )

-

After Graduation (Government & Professional Jobs/Banking & Insurance )

-

After Graduation (Government & Professional Jobs/SSC Exams )

-

After Graduation (Government & Professional Jobs/Railways )

-

After Graduation (Government & Professional Jobs/Teaching )

-

After Graduation (Government & Professional Jobs/ Other Exams )

-

NTSE – National Talent Search Exam: Complete Guide, Eligibility, Syllabus & Benefits.

-

JNVST – Jawahar Navodaya Vidyalaya Selection Test (Class 6 & 9) | Ultimate Handbook, Eligibility Criteria, Syllabus & Key Benefits.

-

AISSEE – Sainik School Entrance Exam (Class 6 & 9) | Comprehensive Guide, Eligibility Criteria, Syllabus & Key Benefits

-

Rashtriya Military School CET:- Detailed Admission Process, Exam Structure & Key Benefits

-

SilverZone Olympiads

-

Homi Bhabha Science Ex

-

VVM – Vidyarthi Vigyan Manthan

-

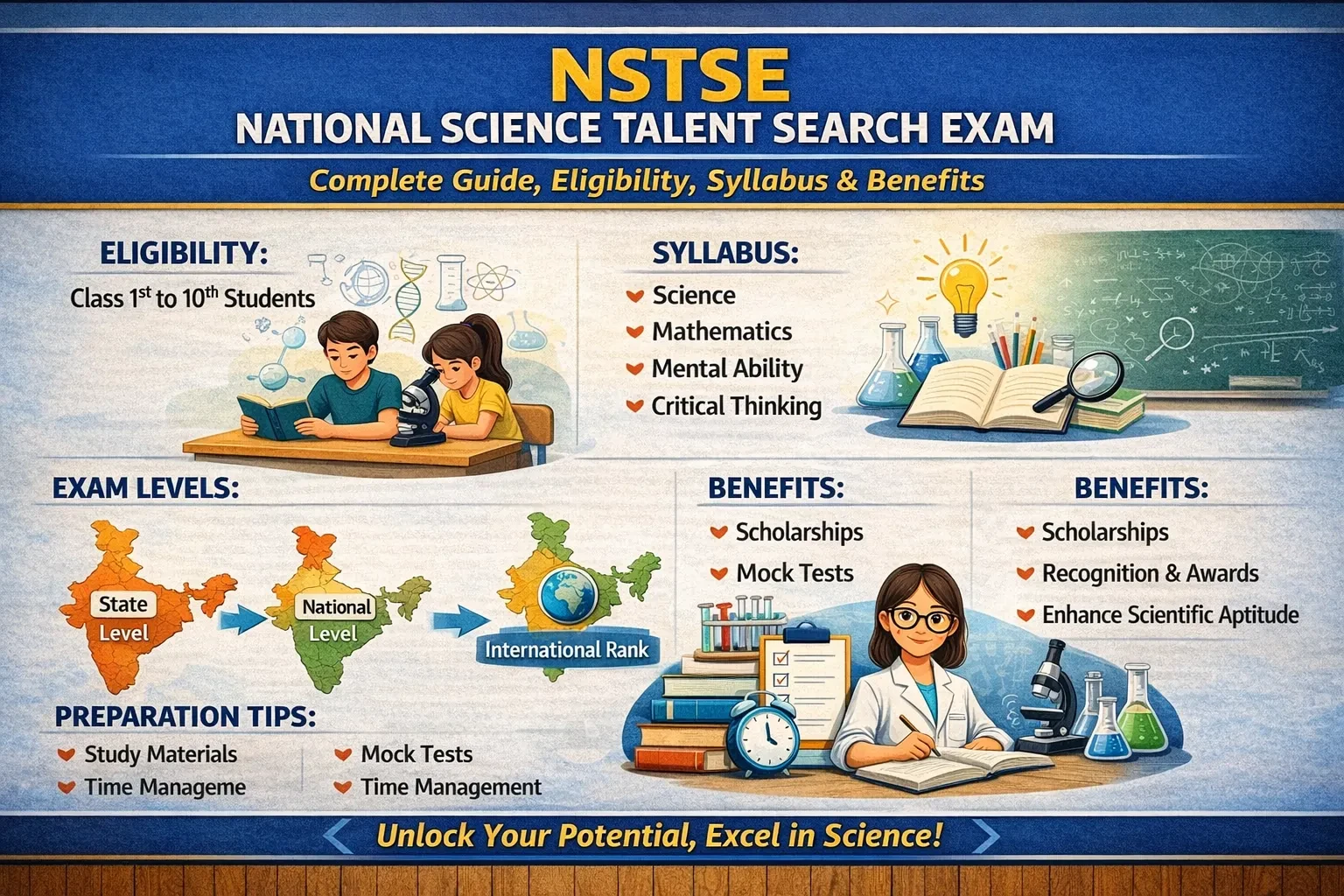

NSTSE – National Science Talent Search Exam: Complete Guide, Syllabus, Eligibility & Benefits.

-

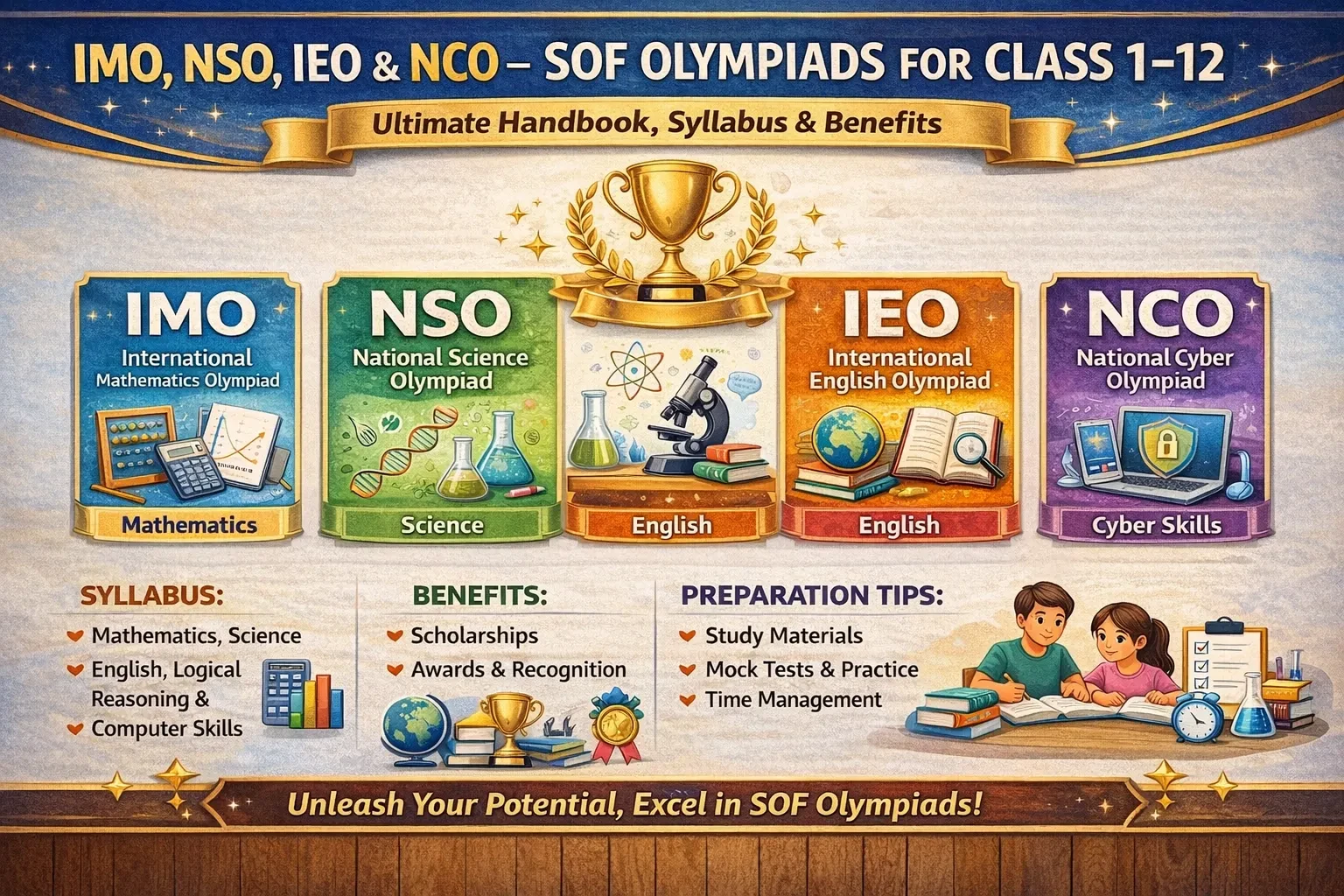

IMO, NSO, IEO & NCO – SOF Olympiads for Class 1st–12th | Ultimate Handbook, Syllabus & Benefits.

-

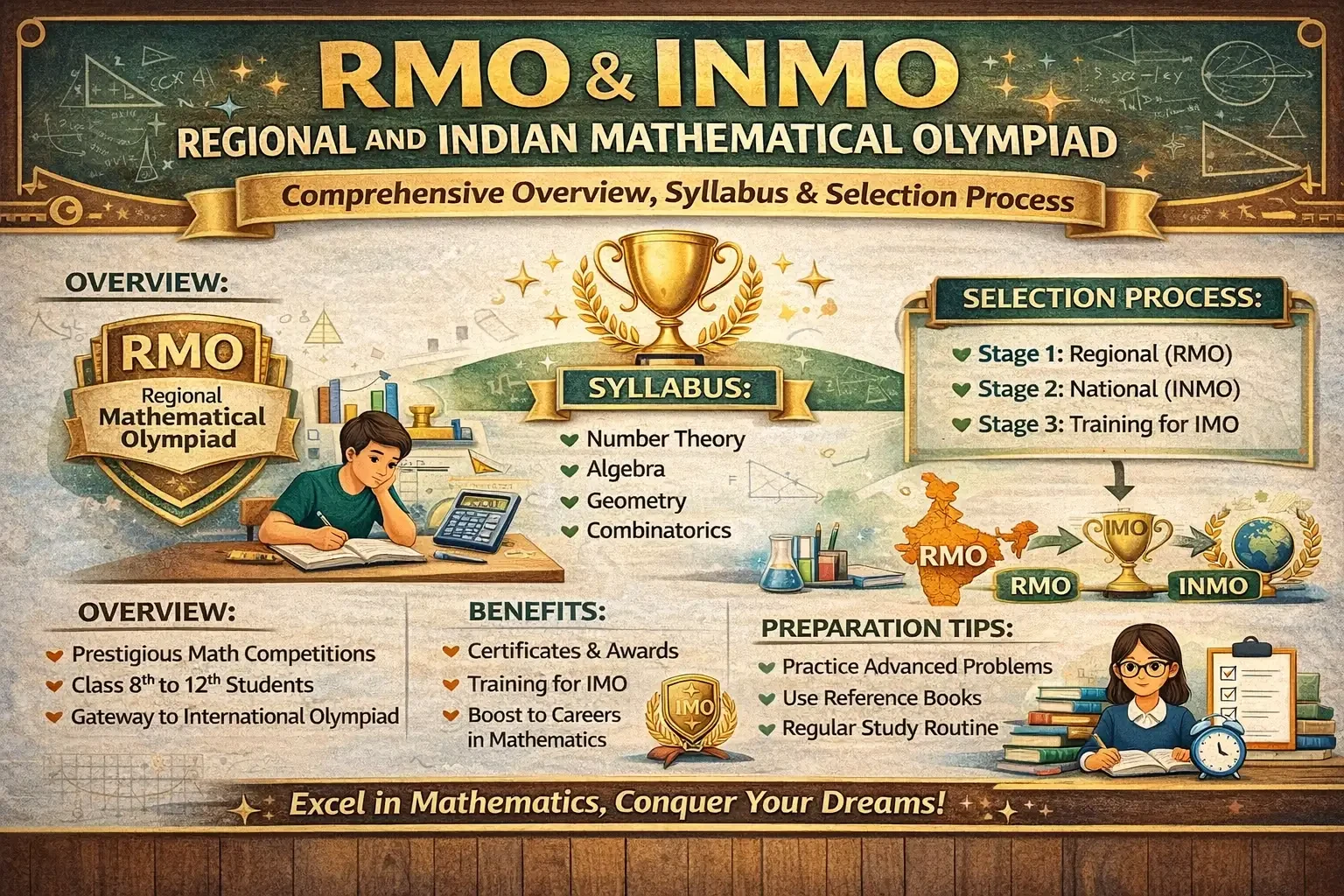

RMO & INMO – Regional and Indian Mathematical Olympiad: Comprehensive Overview, Syllabus & Selection Process.

-

JEE Main – For NITs, IIITs, etc.

-

JEE Advanced – For IITs

-

BITSAT – BITS Pilani Entrance

-

VITEEE – VIT University

-

SRMJEEE – SRM University

-

COMEDK – Consortium of Medical, Engineering and Dental Colleges of Karnataka

-

WBJEE / MHT CET / KCET / UPSEE – State-level engineering exams

-

NEET-UG – For MBBS, BDS, BAMS, BHMS, etc.

-

AIIMS MBBS (merged into NEET)

-

JIPMER MBBS (merged into NEET)

-

NDA – National Defence Academy (UPSC, after Class 12)

-

TES – Technical Entry Scheme (Army)

-

Indian Navy B.Tech Entry

-

Agniveer – Indian Armed Forces recruitment

-

Indian Coast Guard – Navik/Yantrik

-

SSB Interview – After NDA/CDS/technical entries

-

CUET-UG – Common University Entrance Test (for DU, BHU, etc.)

-

IPMAT – Integrated Program in Management Aptitude Test (IIM Indore, IIM Rohtak)

-

CLAT UG – Law entrance (NLUs)

-

NCHM JEE – Hotel management entrance

-

CA Foundation Exam – Chartered Accountancy (after 12th)

-

CPT – Common Proficiency Test (Old name for CA foundation)

-

NATA – Architecture

-

UCEED – Design (IIT Bombay)

-

NID DAT – National Institute of Design

-

NIFT Entrance Exam – Fashion technology

-

UPSC CSE : Complete Guide to IAS, IPS, IFS Exam, Eligibility, Syllabus & Preparation

-

BPSC, MPSC, MPPSC & Other PSCs – Everything You Need to Know Before Applying

-

IBPS PO & Clerk: Build Your Banking Career with the Right Strategy

-

Complete Guide to SBI PO and Clerk Exams: Salary, Syllabus & Online Application

-

RBI Grade B: Exam Pattern, Eligibility, Syllabus, Salary & Career Opportunities

-

LIC AAO / ADO – Complete Guide to Eligibility, Syllabus, Salary & Career Growth

-

NABARD Grade A & B : Exam pattern, Eligibility, Syllabus, Salary & Online Application

-

SSC CGL: Salary & Exam Pattern Explained, Exam Dates, Eligibility, Syllabus & Career Growth

-

SSC CHSL Recruitment: Posts, Salary, Syllabus & Exam Pattern

-

SSC JE: Complete Guide to Exam Date, Eligibility, Syllabus & Career Opportunities

-

RRB NTPC : Exam Date, Result, Admit Card, Eligibility & Qualification Guide

-

RRB Group D : Exam Date, Admit Card, Syllabus, Salary & Online Application

-

RRB JE & ALP Guide: Eligibility, Syllabus, Scope & Career Opportunities

-

CTET & TET : Eligibility, Syllabus, Scope & Career Opportunities

-

UGC NET & CSIR NET Exam Guide for Future Educators and Researchers

-

Teaching Careers in India: Complete Guide to KVS, NVS & DSSSB Recruitment for Students & Graduates

-

CDS for Students: How to Join the Indian Army, Navy & Air Force After Graduation

-

From Classroom to Cockpit – Complete AFCAT Guide for Future Air Force Officers

-

UPSC CAPF Exam– Complete Guide to Eligibility, Syllabus, Preparation & Career Growth

-

IB ACIO Exam– Complete Guide to Eligibility, Syllabus, Preparation & Career Growth in Intelligence Bureau

-

UPSC EPFO EO/AO Exam – Complete Guide to Eligibility, Syllabus, Preparation & Career Growth

-

Complete ISRO & DRDO Recruitment and Career Guide for Students

-

FCI, ESIC, GIC & More – Complete Guide to Government PSUs, Departments & Career Opportunities

-

Cricket Guide for Students - Future Players

-

Football (Soccer) for Students: Skills, Rules, Training & Career Opportunities

-

Badminton for Students: Skills, Strategies & Steps to a Professional Career

-

Complete Kabaddi Guide for Students & Future Champions

-

From Court to Career – Complete Tennis Guide for Students: Rules, Skills & Opportunities

-

Wrestling Guide: Skills, Rules & Career Opportunities for Students

-

Complete Boxing Guide: Rules, Skills, Training & Career for Students

-

Smash & Spin: Complete Guide to Table Tennis Skills, Rules & Equipment

-

From Dribbles to Dunks – Complete Guide to Basketball Rules, Techniques & Skills

-

Mastering Volleyball – Techniques, Positions, Rules, Winning Strategies, Skills & Famous Players

-

Athletics Sports: Complete Guide to Running, Jumping, Throwing & World Championships

-

All About Chess – History, Rules, Techniques & World Championships

-

Golf Sports – History, Rules, Techniques & Benefits Explained

-

Squash Sports – History, Rules, Techniques & Benefits Explained

-

Kho-Kho Sports – History, Rules, Techniques & Benefits Explained | Learn Kho-Kho

-

Mallakhamb Sports: The Ancient Indian Art of Strength, Balance, and Flexibility

-

Polo Sports: The Royal Game of Skill, Speed, and Teamwork

-

Archery Sports: Definition, Skills, History & More

-

Judo: The Gentle Way of Martial Arts and Combat Sports

-

Taekwondo Martial Arts: The Power of Discipline and Self-Defense

-

Karate: The Art of Self-Defense and Discipline for All Ages

-

🥋 Mixed Martial Arts (MMA): The Ultimate Combat Sport Explained

-

All About Rowing, Canoeing & Sailing Sports | Rules, Benefits & Safety Tips

-

🏊♂️ Swimming and Diving for Students – Fun, Learning, and Water Safety, Rules, Techniques, and Benefits

-

Top Winter Sports in Northern States: Ice Hockey & Skiing Adventures

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

-

-

Counselling

-

0-5 class

-

6th-10th class

-

After 10th

-

After 12th

-

After Graduation

-

Academic ( Study strategies, course planning )

-

Govt. Courses ( Navodhya, NDA etc. )

-

Career ( Related to JOBS )

-

Personal/Psychological ( Well-being, mental health )

-

Life Skills Counseling

-

Health and Wellness Counseling

-

Time Management Counseling

-

Relationship Counseling

-

Cultural Competency Counseling

-

Vocational/Skill ( Job skills, certifications )

-

Social/Behavioral ( Interpersonal, teamwork, leadership )

-

Group/Peer ( Shared issues, support )

-

Crisis Intervention ( Emergency support )

-

Department-Specific ( Industry trends, specialized advice )

-

Why these classes are important

-

Building Self-Confidence and Self-Worth

-

Developing Social and Friendship Skills

-

Emotional Regulation and Expression

-

Academic and Organizational Skills

-

Positive Decision-Making and Problem-Solving

-

Respect and Tolerance for Diversity

-

Personal Safety and Responsibility

-

Goal Setting and Perseverance

-

Developing Self-Identity and Confidence

-

Emotional Regulation and Mental Health

-

Building Healthy Relationships and Social Skills

-

Responsible Decision-Making and Problem-Solving

-

Academic Planning and Organization

-

Respect for Diversity and Inclusion

-

Self-Care and Healthy Lifestyle Choices

-

Add tab for Competitive exam from other menu

-

Time Management

-

Study Habits

-

Active Recall & Spaced Repetition

-

Memory & Focus : How to Focus and Avoid Distractions

-

Memory & Focus

-

Exam Prep.

-

Learning Styles

-

Goal Setting

-

Using Technology to Support Study

-

Stress Management ( Identify stress & cope healthily )

-

Anxiety ( Recognize signs, use mindfulness )

-

Emotional Regulation ( Express emotions, anger management )

-

Self-Esteem & Self-Compassion ( Build self-worth, positive self-talk )

-

Healthy Relationships ( Communicate, set boundaries )

-

Grief, Loss, & Change ( Grieving is normal, seek support )

-

Resilience & Problem-Solving ( Challenges as growth, use problem-solving steps )

-

Balance in Life ( Integrate rest, manage time )

-

Seeking Help ( Know support options, reduce stigma )

-

Healthy Lifestyle

-

Self-Awareness and Empathy

-

Effective Communication

-

Interpersonal Relationships

-

Decision Making

-

Problem-Solving

-

Critical and Creative Thinking

-

Coping with Stress and Emotions

-

Time and Self-Management

-

Adaptability and Resilience

-

Ethical Values and Responsible Behavior

-

Building Confidence in Primary Students: Celebrate Strengths and Achievements

-

Support their efforts with positive feedback and reinforcement.

-

Helping Children Believe in Themselves by Setting Realistic, Achievable Goals

-

Teach the importance of sharing, cooperation, and kindness in group activities.

-

Role-play to practice effective communication and conflict resolution with peers.

-

Building Safe Classrooms: Helping Class 1–5 Students Handle Teasing, Bullying, and Inclusion

-

Teach Kids to Recognize and Name Their Emotions with Ensure Education Counselling

-

Teaching Calmness: Helping Class 1–5 Students Manage Emotions Through Relaxation Techniques

-

Nurturing Emotional Expression in Young Learners: How Safe Creative Outlets Build Confidence

-

Building Organized Minds: Teaching Class 1–5 Students the Art of Planning and Responsibility

-

Effective Counselling for Class 1–5: Introducing Simple Study and Time-Management Tips

-

Encourage curiosity and questions to nurture a love for learning.

-

Building Smart Thinkers — Teaching Good Decision-Making Skills Through Stories, Games, and Role-Play

-

Helping Children Become Smart Problem-Solvers – Teaching the Steps of Solving Everyday Problems

-

Nurturing Respect and Equality – Teaching Children to Value Every Individual

-

Exploring Similarities and Differences Through Group Activities

-

Teaching Children Empathy and Understanding Towards Others

-

Teaching Safety with Confidence – Understanding Personal Boundaries, Safe Touch, and Trusted Adults

-

Reinforcing Personal and School Safety Rules for Young Learners

-

Guiding Students to Set Short-Term, Age-Appropriate Goals

-

Teaching the Importance of Trying Again After Setbacks

-

Helping Children Discover Their Strengths, Interests, and Passions for Lifelong Success

-

Building Confidence in Students — Encouraging Positive Self-Talk and Recognition of Achievements

-

The Power of Authenticity — Helping Students Embrace Their True Selves

-

Helping Students Manage Stress, Anxiety, and Emotions with Simple and Effective Strategies

-

Normalizing Conversations About Emotions and Mental Wellness in Students

-

Helping Students Recognize When to Seek Support from Trusted Adults or Counselors

-

Building Confident Communicators: Practicing Assertiveness, Active Listening, and Respectful Disagreement

-

Nurturing Empathy and Kindness Through Role-Play and Collaborative Learning

-

Helping Students Handle Peer Pressure, Inclusion, and Build Healthy Friendships

-

Helping Students Make Better Choices Through Real-Life Scenarios

-

Fostering Critical Thinking and Smart Decision-Making in Students

-

Teaching Digital Responsibility and Safe Online Behavior

-

Building Effective Study Habits, Time Management, and Organizational Skills

-

Empowering Students to Achieve Success Through Smart Goal Setting and Planning

-

Building a Growth Mindset: Turning Challenges into Opportunities for Learning

-

Fostering Cultural Awareness and Respect: Helping Students Appreciate Diversity

-

Building Respect and Understanding — Addressing Stereotypes, Prejudice, and Bullying

-

Building Unity and Confidence Through Inclusive Teamwork and Class Discussions

-

Building Healthy Habits — The Importance of Sleep, Nutrition, and Physical Activity for Student Well-Being

-

Growing with Confidence — Understanding Personal Hygiene and Puberty Changes

-

Finding Balance — The Importance of Hobbies, Leisure, and Personal Downtime for Students

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

- No blogs available

-

Discovering Yourself — Understanding Personal Strengths and Weaknesses

-

Understanding Feelings — Recognizing Emotions and Their Impact

-

Building Sensitivity to Others’ Feelings and Perspectives

-

Mastering Effective Expression: Developing Verbal and Non-Verbal Communication Skills

-

Strengthening Student Communication: Developing Active Listening and Assertive Expression

-

Communicating with Clarity and Respect: Helping Students Express Ideas Effectively

-

Nurturing Strong and Positive Friendships for a Happier School Life

-

Building the Spirit of Teamwork: Guiding Students to Collaborate and Succeed Together

-

Building Harmony: Teaching Students to Respect Diversity and Resolve Conflicts Peacefully

-

Helping Students Make Wise Choices: Learning to Identify Options and Weigh Consequences

-

Guiding Students to Make Thoughtful and Responsible Life Choices

-

Helping Students Set Goals and Stay Focused on What Truly Matters

-

Guiding Students to Think Smart: Understanding Problems and Finding Solutions

-

Analyzing root causes and brainstorming alternatives

-

Applying strategies to real-life challenges

-

Evaluating information and arguments objectively

-

Thinking out-of-the-box for innovative solutions

-

Reflecting on experiences to learn and grow

-

Recognizing sources of stress and emotional triggers

-

Strategies such as mindfulness, relaxation, and self-care

-

Building resilience to overcome setbacks

-

Planning, organizing, and prioritizing tasks

-

balancing academic, personal, and extracurricular demands

-

Developing self-discipline and motivation

-

-

Ensure TV

About Us

About Us

Insights & Awareness

Insights & Awareness